Aconto i Mediesystemet

Contents

Fakturering med A-contohantering

- Löpande A-contoavräkning avräknas i den allmänna faktureringen under fliken Fakturering.

- Ej löpande a-contoavräkning avräknas under fliken Acontoavräkning.

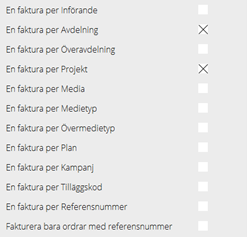

- Villkoren för a-conto gäller endast per faktura, det vill säga om en av fakturans order uppfyller villkoren så räknas hela fakturabeloppet av och inte orderns belopp. Vill man undvika detta ska fakturan delas genom fakturainställningarna på kunden i Basregister/MED/Kunder/Fakturering, se bild.

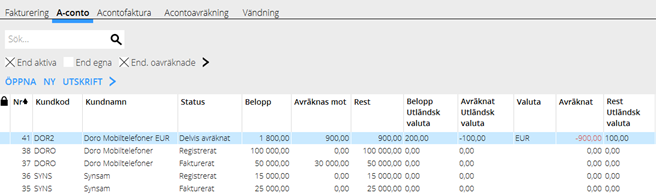

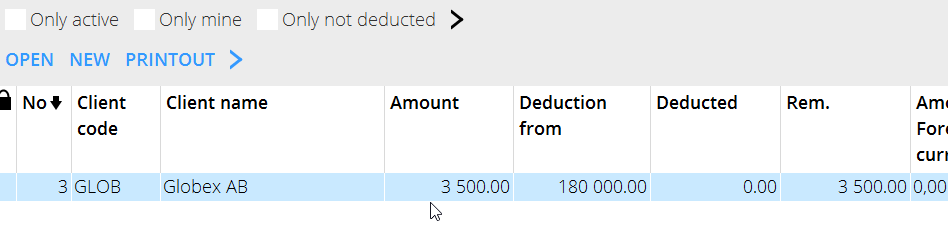

Endast aktiva betyder bara att a-conton ligger synbara i listan. När ett a-conto har räknats av och tömts/avslutats får det status avräknat och visas bara om man tar bort krysset. Kolumnen ”Avräknas mot” visar det belopp som kan räknas av och till den kurs som ligger i basregistret eller om man angett en specifik kurs inne i ordern. Belopp visas om man:

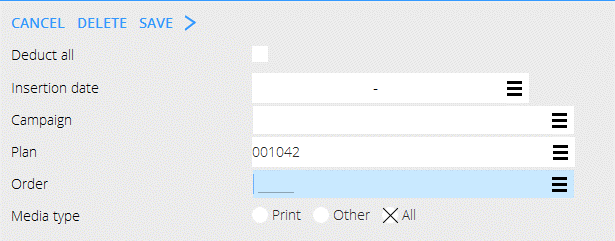

- Har markerat för ”avräkna allt”

- Har lagt in specifika planer/order/period eller annat kriterium.

- Lägger man inte in specifik plan/order eller markerar för ”Avräkna allt” visas inget belopp i listan under Avräknas mot. Det betyder att avräkning kan ske mot alla definitiva införanden som ligger på kunden och med Löpande a-contoavräkning i avtalen. Denna löpande a-contoavräkning görs i den allmänna faktureringen.

Avräkning sker succesivt på a-contonumren och fortsätter så länge det finns belopp att räkna av.

Avtal med Löpande a-contoavräkning:

Vid utskrift under A-contoavräknings-fliken kommer de planer/ordrar med som ligger listade under ”Avräknas mot” eller allt om man markerat för ”Avräkna allt”. Om inget ligger listat under ”avräknas mot” skrivs a-contot ut och avslutas utan avräkning.

Vid utskrift under fliken Fakturering kommer alla de planer/ordrar med som ligger definitiva oavsett vad som är listat listade under ”Avräknas mot” eller är tomt. Gör alltså ingen skillnad.

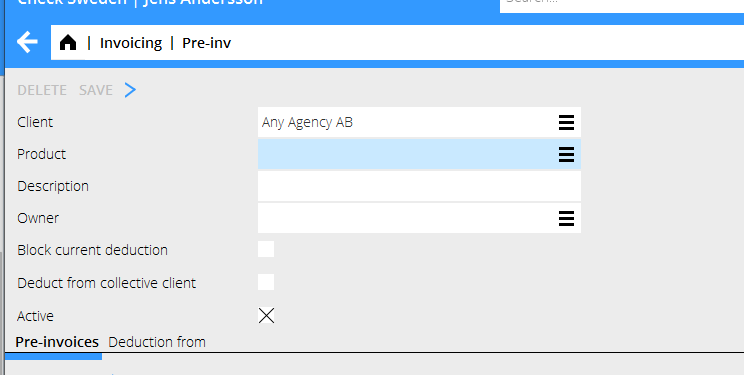

If you want to avoid deduction from a certain pre-invoice, you can Block current deduction. That is only possible if nothing is listed under ”Deduction from”.

If you want to remove “Deducted from”, open the row/rows and delete.

Agreement with No current pre-invoice deduction:

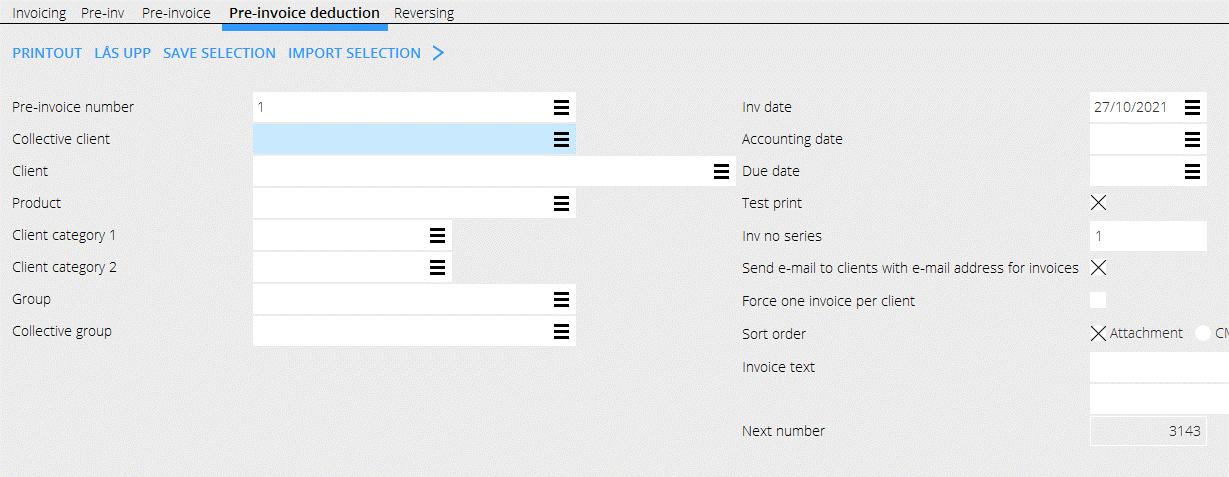

When printing out under the tab Pre-invoice deduction, all the plans/orders listed under” Deduction from” - or all, if you have checked “Deduct all” - will be included. If there is nothing under ”Deduction from” the pre-invoice will be printed out without deduction.

When printing out under the tab Invoicing, there will be no deduction. If plans/orders are listed under ”Deduction from”, they will be blocked from being invoiced in the usual manner.

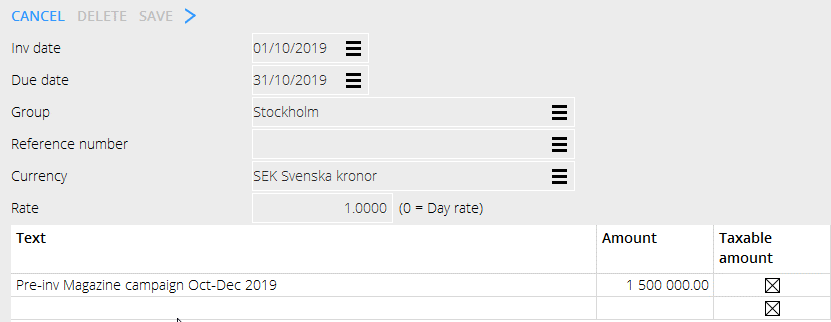

Handling of pre-invoices in foreign currency

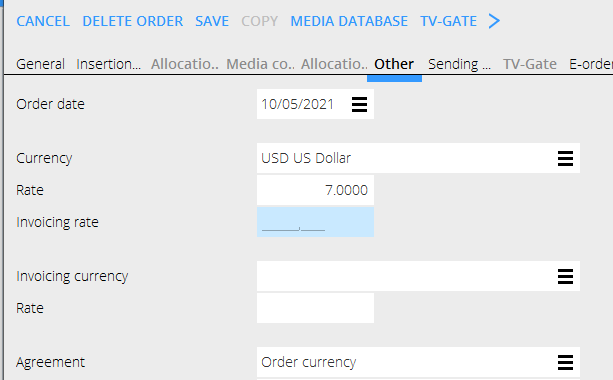

When setting up a pre-invoice in another currency, you must state the currency rate on the invoice. The deductions are not following the stated rate on the pre-invoice; they follow the client agreement with either day rate according to the base register or order rate stated on the order.

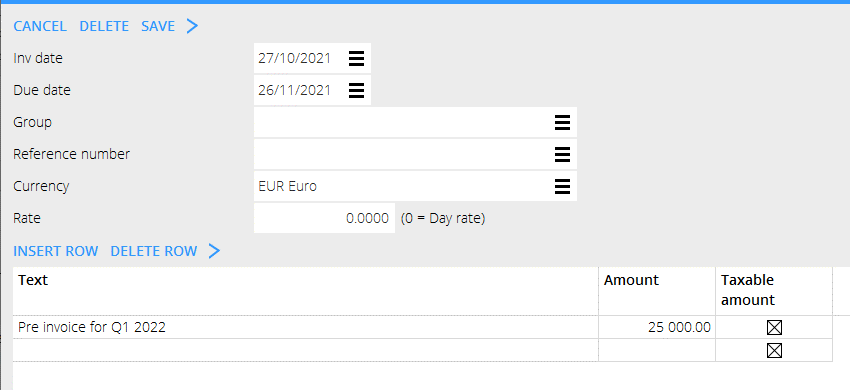

The pre-invoice:

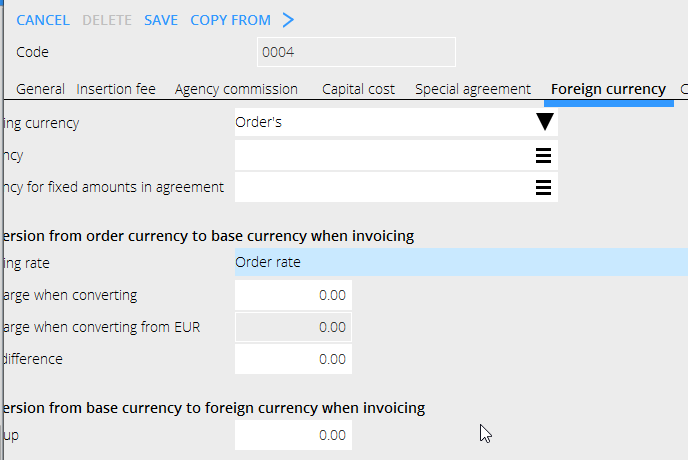

The client agreement where rate shall be stated on the order:

The order:

The order:

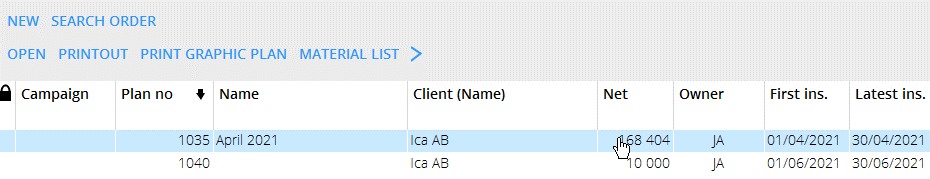

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

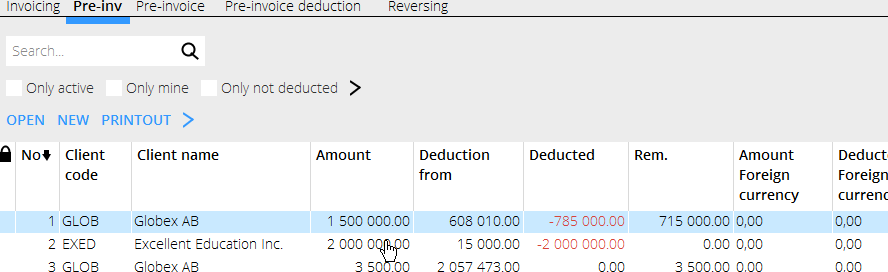

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

Create new pre-invoice with No current deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.

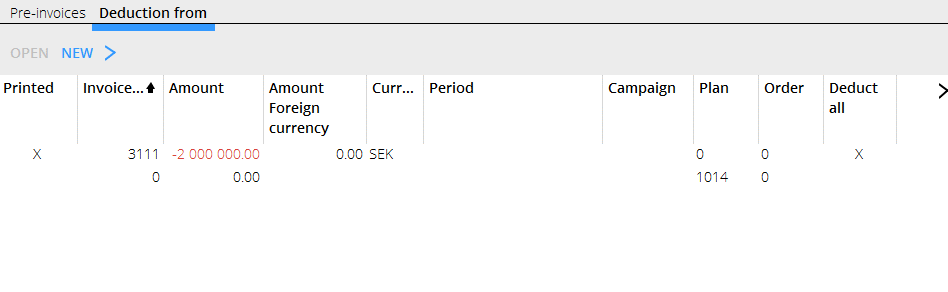

- State where the pre-invoice shall be deducted from. You can add more rows under “Deducted from”.

- Plan 1092 ”Februari kampanj” is on 700 000 which you can see in the list under Deducted from.

- The deduction is done in Pre-invoice deduction

Here we are certain that this pre-invoice will be settled to zero and deducted from the stated plan. If the plan only has a smaller amount, the deduction takes what it can, and the remaining pre-invoice generates a credit invoice. Or vice versa if the plan has a bigger amount. The pre-invoice is settled.

Create new pre-invoice for current pre-invoice deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.

- Current pre-invoice deduction means that it can be deducted from all definitive insertions on the client. This current deduction is done in the general Invoicing.

Deduction is done continuously on all pre-invoice numbers on the same client code and continues as long as there are amounts from which to deduct. When the pre-invoice/-s have been used to the end, the remaining amount is generated to the invoice.