Expense reports startup

Describes the preparations you must make in order for the Expense reporting to work properly.

Contents

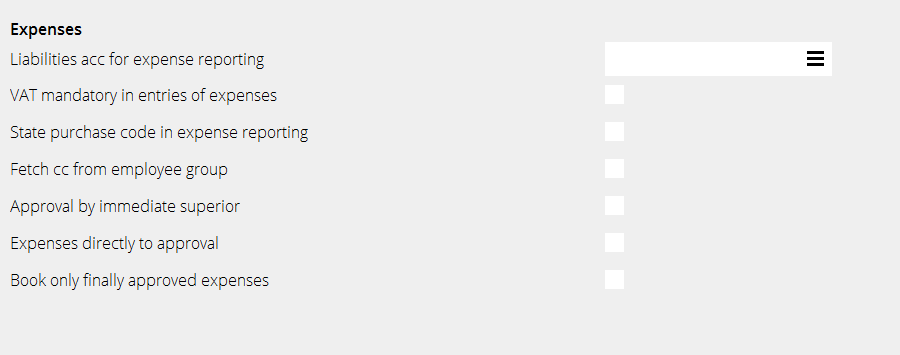

Settings

Parameters

Set parameters in Base registers/GL/Parameters/Registration/Expenses.

| Liabilities acc for expense reporting | Enter account. If payments shall be sent via Marathon, make sure that the account is assigned to the Purchase Ledger. The account must also have assignments to Cost objects (Base registers/GL/Account). |

| VAT mandatory in entries of expenses | Check the box it the employee will have to enter the VAT amount in the expense report. |

| State purchase code in exp. reporting | Check, if the employee will be given the possibility to enter a purchase code in the expense report. |

| Fetch cc from employee group | If the liabilities account for expense reports requires cost centre, check the box if it shall be fetched from the group that the employee belongs to. |

| Approval by immediate superior | Check the box if expense reports have to be approved by the employee’s immediate superior before further handling. |

| Expenses directly to approval | Check the box if an expense report directly can be approved by the immediate superior. If left unchecked, the accounting department approves the report (in Bookkeeping/ Expense reports watch list) and checks the box Ready for approval before the immediate superior gets to see it and finally approve it.If checked, and the immediate superior is stated on the user (Base registers/General/Users, tab Other) he/she will see the report directly in Project/Approval |

| Book only finally approved expenses | Check, if the expense report has to be fully approved before it can be booked by the accounting department. |

Authorisation

Set authorisation levels for the expenses module in Administration/Authorisation under Bookkeeping and connect them to the user in Base registers/General/Users, tab Authorisation.

Cost objects

Set up new cost objects in Base registers/GL/Cost objects. Use the same code as user- and employee codes.

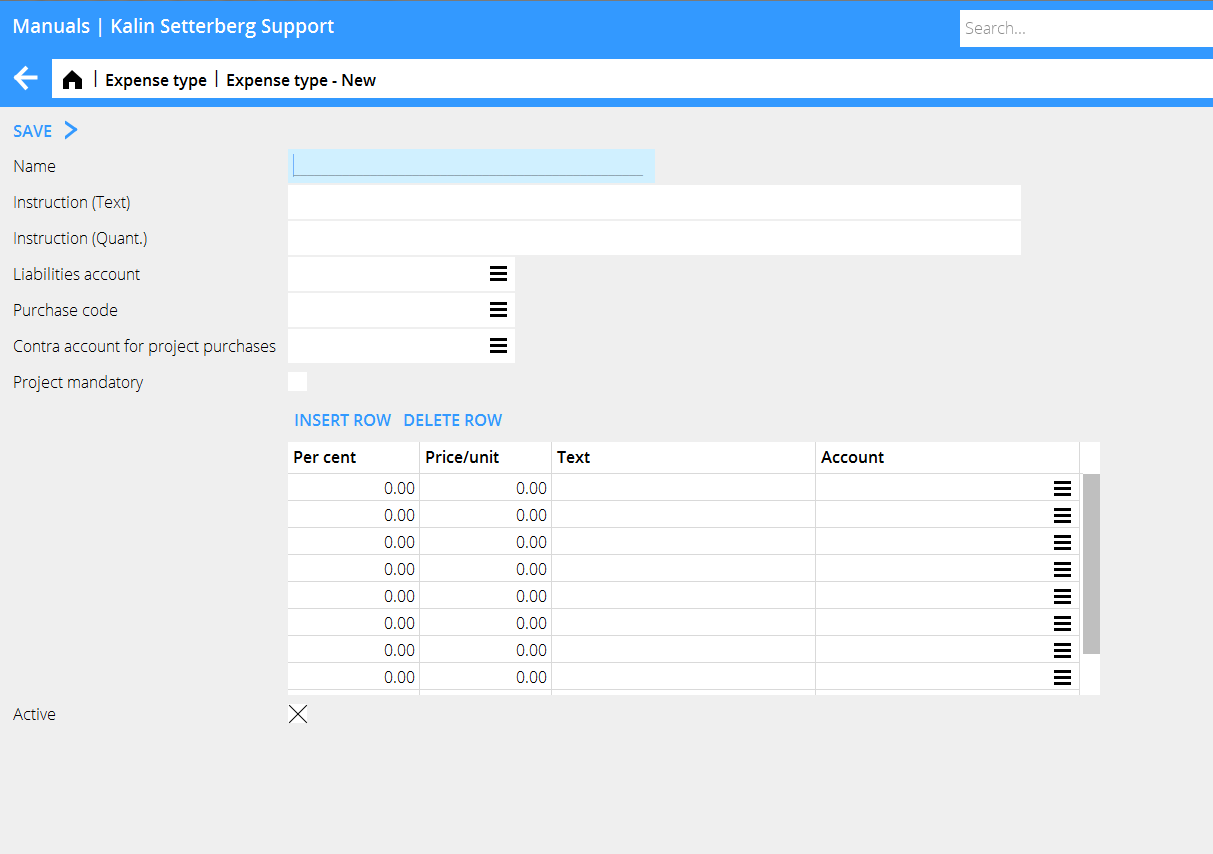

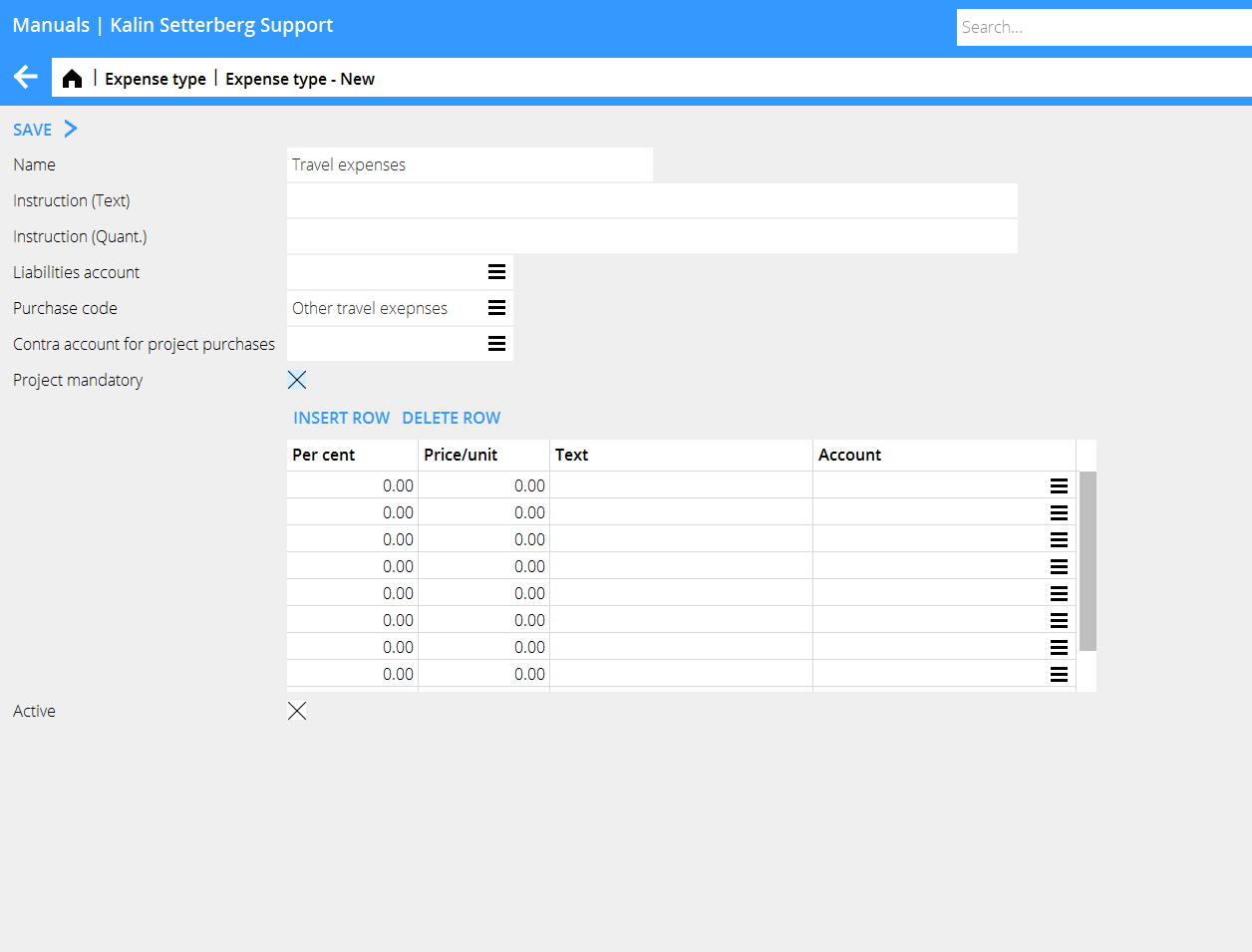

Expense types

By using different expense types, entering expense reports as well as booking them will be easier. The different types can be selected from a drop-down menu. Yet we recommend not having too many expense types. Create new and administrate expense types in Base registers/GL/Expense types.

| Instruction | Instructions written in the two fields (text and amount) makes the fields mandatory when entering an expense report. |

| Liabilities account | An alternative account to the one set in the parameter (optional). |

| Purchase code | If the expense is booked on an external project, enter purchase code. |

| Contra account for project purchases | A rarely used setting. An account in credit can be stated when an expense is entered on a project. (The account for project purchases set in the parameters in Base registers/PL/Parameters/Preliminary entering will be automatically debited). |

| Project mandatory | Check the box if project will be a mandatory field in the expense report. |

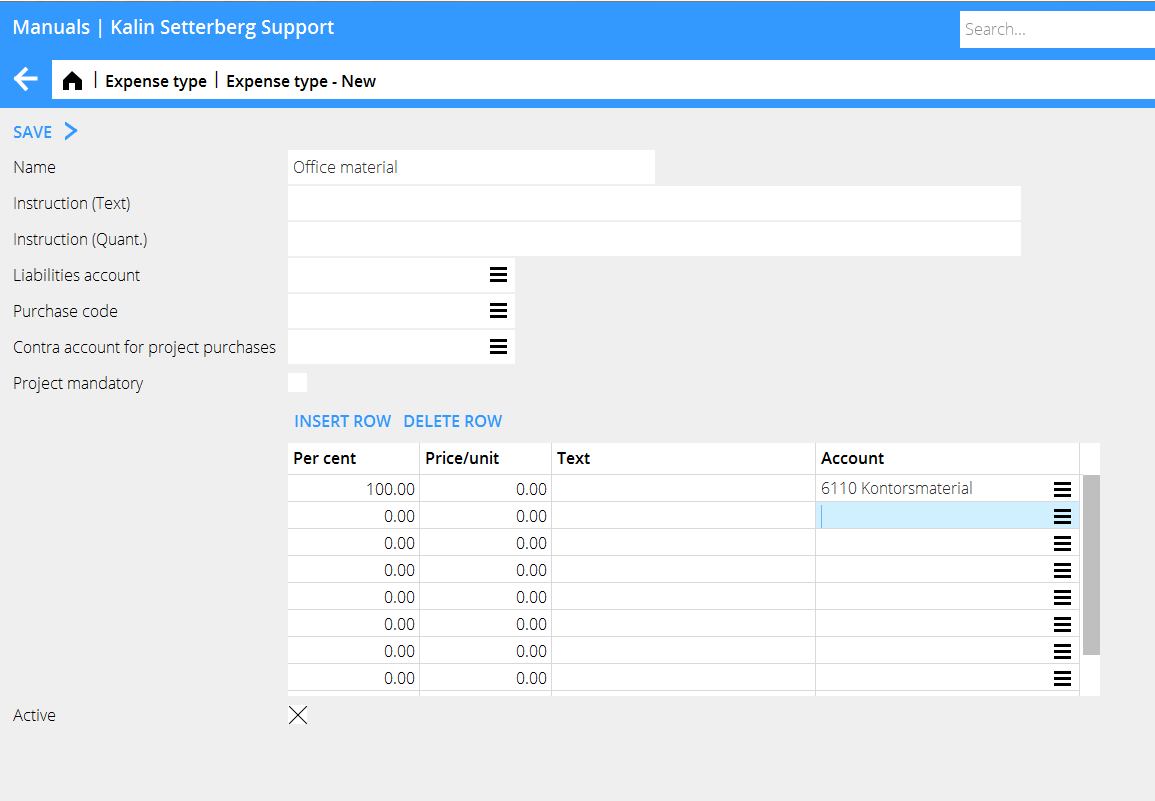

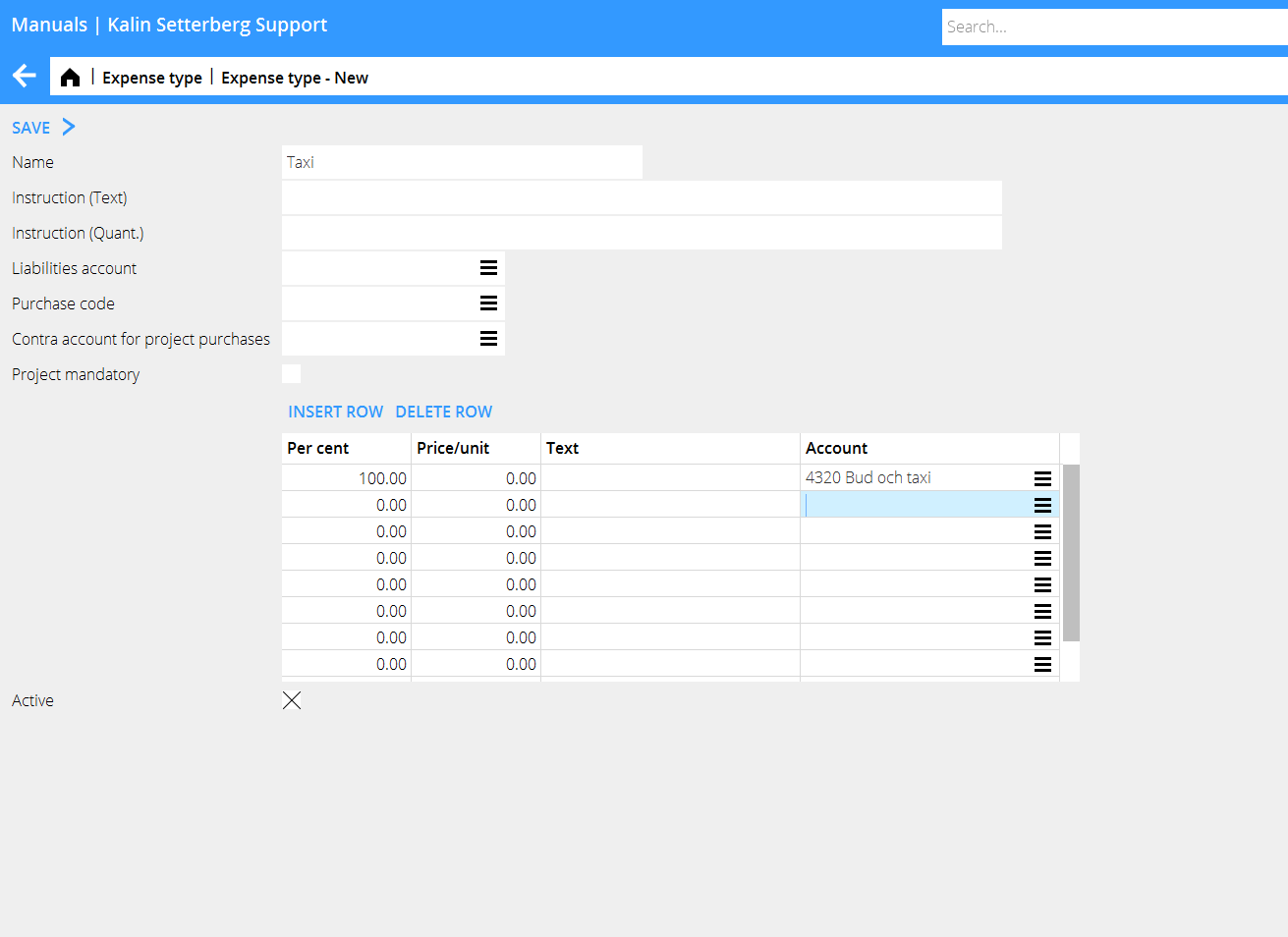

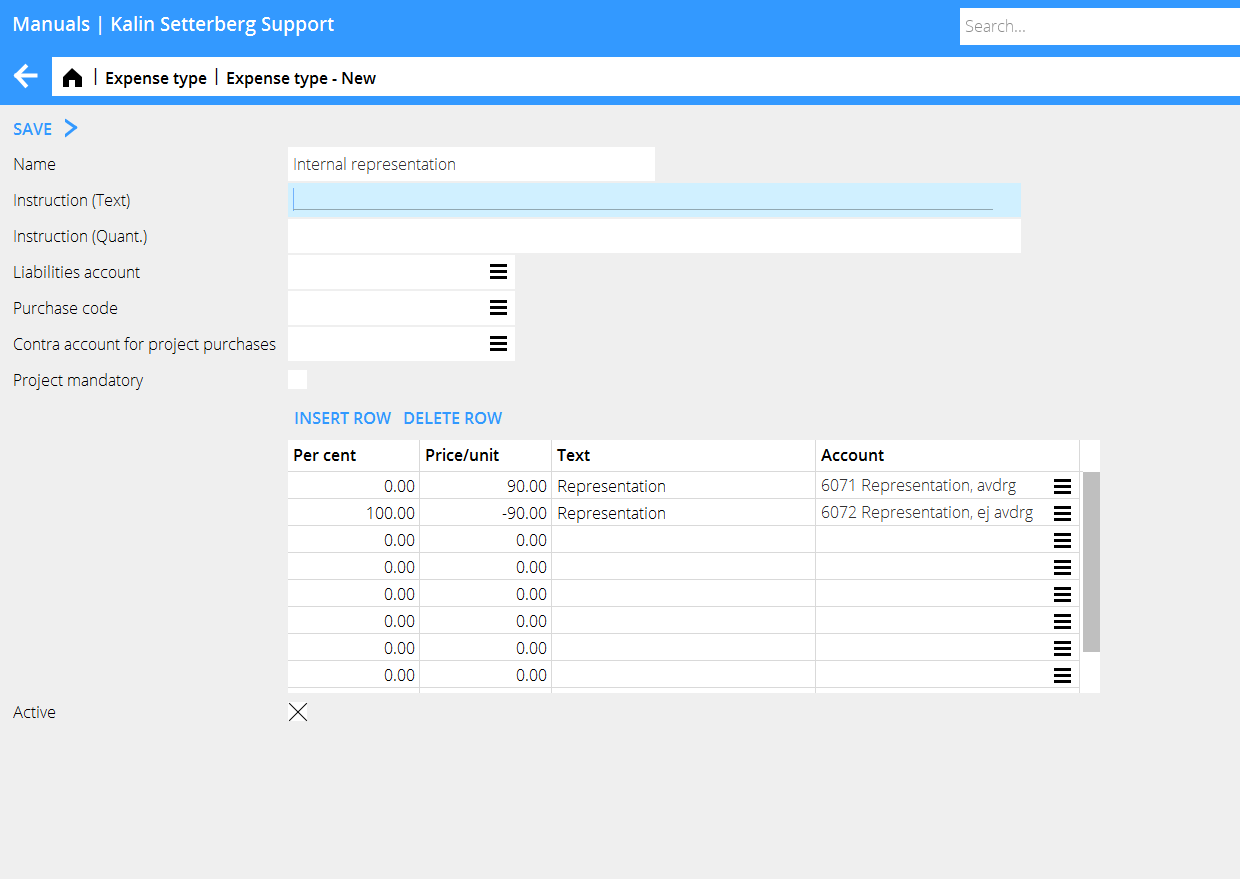

Use the table for determining how the posting of the expense shall be done. You can either make it simple and just enter an account that shall be suggested to the employee when entering expenses, or use a variety of combinations such as fixed prices, unit prices, percentages of the total sum to different accounts, etc. to facilitate the bookkeeping procedure.

If the employee is entering a project on an expense row, the expense will be considered and posted as a project regardless of expense type. The reason for this is to avoid missing a project purchase.

| Project purchases |

Project purchases are posted on the account for purchases stated in the parameters in Base registers/PL/Parameters/Preliminary entering

| Office material |

| Taxi |

| Internal representation |

When booking internal representation, the VAT posting has to be done manually.

Disbursement of expenses

The disbursement to the employee is done the same way as payments to a supplier. The best payment method is Bank account without notification. The following settings are required before disbursement.

| Supplier | If the disbursement is executed via Marathon, the employee has to be filed as a supplier in Base registers/PL/Supplier with the same code as his/her employee- and user codes. |

Required fields:

| Name | (tab General) |

| Address | (tab General) |

| Payment method | Bank account without notification (tab Payment) |

| Rec account | The whole bank account number inclusive of clearing number (tab Foreign payments) |

| Trade creditors’ account | Liabilities account for the expense report (tab Other) |

| Cost object | (tab Other) |

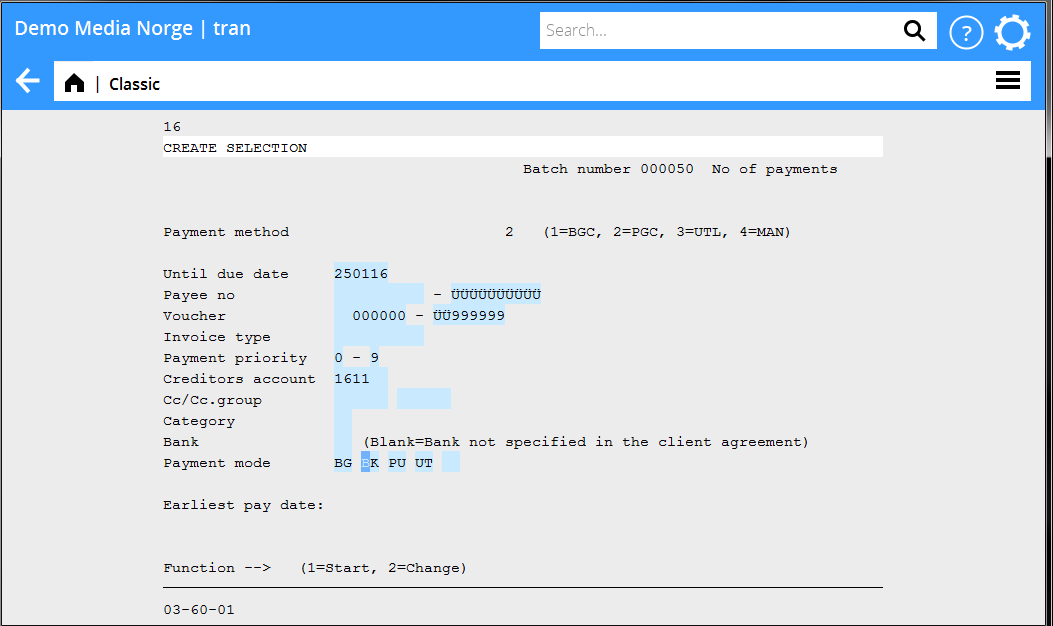

| Payment selection | Print a payment selection in 03-60-01 and filter on the creditor’s account, which is stated on the expense type. Choose payment method BK.

The disbursement is made the same way as payment of suppliers’ invoices via the Payment program or file transfer to the bank. |