Group consolidation

Group consolidation

Start

Set up a company to be used for consolidation in System | Base registers | Companies. The company must have the subsystem G/L and Company for consolidated balances checked under the GL tab. In Accounting| Back Office | Base registers | Parameters, open the year, and under the Other tab for Company for global report generator, specify which company's report generator the group balance sheet company should be linked to.

Consolidation process

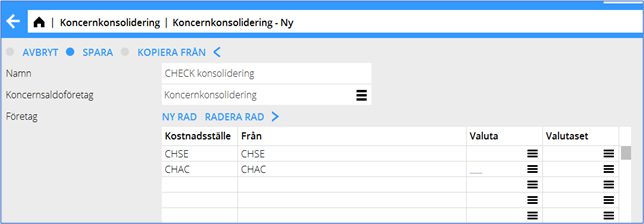

- Select New under Accounting | Backoffice | Group consolidation.

- Give the consolidation a name and select company for consolidated balances in the field for it.

- The companies to be consolidated are listed in the Cost Centre column. The name here is the name that the balance is marked with in reports after consolidation (they are listed as cost cen-tres but do not need to be set up as such).

- The From column lists the companies to be consolidated. Here, one or more cost centres from a company can be specified and calculations can be made. See example 2 below.

- If consolidation is to be in another currency, the currency is specified in the Currency column. If no currency is specified, the currency used will be that of the group consolidation company. Currency conversion is performed for each period, i.e. if consolidation is performed for the period 0125-1225, each month will be converted based on the exchange rate applicable on the last day of each month.

- In the Currency Set column, you can specify a ready-made currency set to use a fixed exchange rate for the entire year. The currency set is created in System | Basr registers | Currency Set.

- Save and press the Consolidate button to start the consolidation.

Print reports under Accounting | Reports, Accounting tab.

Example

Example of consolidation of companies CHSE and CHAC:

Example of consolidation where only certain cost centres per company are included:

Explanation

Row 1 Everything is fetched from company CHSE except what is on CC 01, CC 02 and CC 03

Row 2 CC 01 in company CHSE

Row 3 CC 01 in company CHAC plus CC 03 in company CHSE