Invoicing

Contents

- 1 Invoicing

- 1.1 Preparations

- 1.2 Invoice text and content

- 1.3 Create invoice when invoice text exists

- 1.4 Select invoice content

- 1.5 Adjust the WIP

- 1.6 Columns in the adjustment view

- 1.7 Print invoice

- 1.8 Invoice distribution

- 1.9 Sending queue

- 1.10 Create invoice without invoice text ready

- 1.11 Excess invoicing

- 1.12 Pre-invoice

- 1.13 Collective invoice

- 1.14 Invoices in foreign currency

- 1.15 Parameters on the invoice

- 1.16 Reprint invoice

- 1.17 Credit or reverse invoice

- 1.18 Invoice client

- 1.19 Delimit WIP

- 1.20 Details Fees

- 1.21 Zero invoicing

Invoicing

This section describes the various steps involved in project invoicing. Everything from preparations and adjustments to printing invoices for clients. Among other things, it explains how to create a pre-invoice or a collective invoice, an invoice in another currency, and how to reverse or credit an invoice. It also describes some of the most common parameters related to invoicing.

Preparations

- Check that everyone has reported their hours in the list Reconciliation Time in Projects | Reports.

- Update Fees, Purchases and Other in Projects | Backoffice | Transactions, unless automatic update is enabled.

Invoice text and content

An invoice consists of invoice text and invoice content. Content is the amounts from either WIP or pre-invoice that has been marked to be invoiced. The text and content must match in order for the invoice to be printed out. The procedure for preparing an invoice varies slightly depending on the type of invoice and whether the invoice tab within the project is used. See separate sections below.

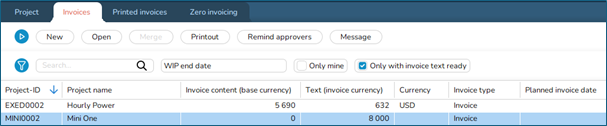

Create invoice when invoice text exists

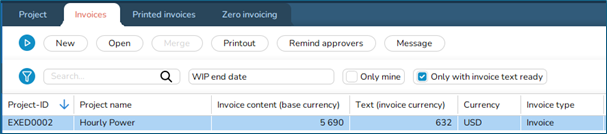

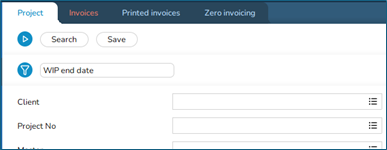

- Go to Projects | Invoicing, tab Invoices. There you can see invoices that have been started but not printed.

- Select an invoice and press Open.

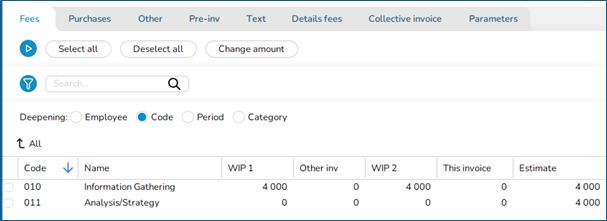

Select invoice content

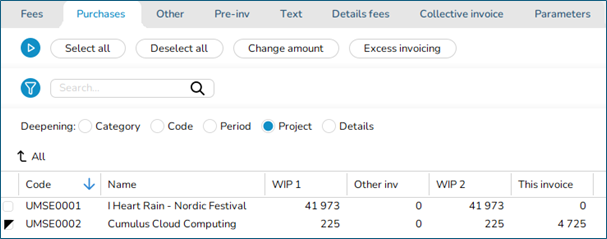

- Go to tabs Fees, Purchases, Other and | or Pre-invoice, depending on what shall be invoiced.

- If needed, change Deepening. In Fees you can deepen on Employee, Category, Code or Period. Double click on a row to see details about it.

- Tick in the rows that you want to include in the invoice. The selected WIP amount will be moved to the column This inv.

- If not everything is to be invoiced, partial invoicing is possible by selecting one or more lines and pressing the Change amount button. Enter the amount to be invoiced. The remaining amount remains in WIP.

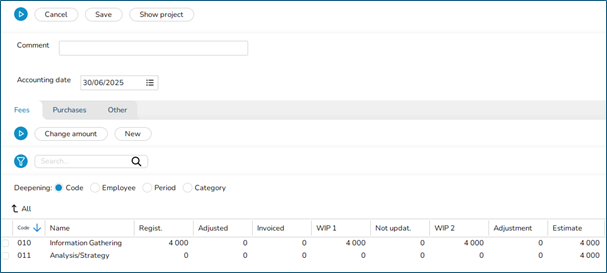

Adjust the WIP

- An adjustment is an upward or downward write-down of the sales WIP to bring WIP levels in line with what is to be invoiced. There are two ways to make an adjustment: either from the Project tab using the New adjustment button, or from within an invoice.

- Click on the Adjust button on the invoice or on the New adjustment button in the project list.

- Go to the Fees, Purchases or Other tab, depending on what shall be adjusted.

- If needed, change Deepening. In Fees you can deepen on Employee, Category, Code or Period. Double click on a row to see details about it.

- Select the rows to be adjusted and press the Change amount button. When selecting more than one row, the adjustment will be made proportionally against WIP or Registered.

- Enter the amount (+ | -) that shall be adjusted, alternatively enter the amount that shall be remaining in the WIP field.

- By checking the box on the left, the entire row is adjusted to zero.

- To make a new adjustment without WIP or registered on the project, press New. Enter Employee, Code, Period and Amount.

- Write optional adjustment comment

- Enter accounting date and Save

Columns in the adjustment view

| Registered | The registered amount |

| Adjusted | Total adjusted |

| WIP 1 | Everything registered and adjusted but not invoiced |

| Invoiced | The invoiced amount |

| Not updat. | Amount in created but not printed invoices |

| WIP 2 | Columns WIP 1 minus Not updated |

| Adjustment | A new adjustment that hasn’t been saved |

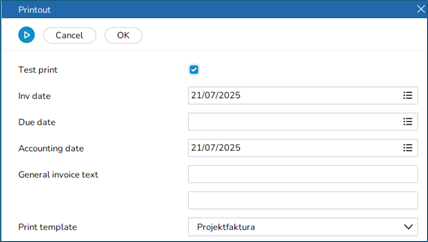

Print invoice

- When invoice content and text are ready, press Save to get to the Invoices tab.

- Select the invoice and press Printout. If you wat to print out several invoices, keep the Ctrl key pressed while selecting invoices.

| Test print | You can print a test print to see how the invoice looks like |

| Inv. date | Today’s date is suggested. If you print out several invoices, the invoice date of the previous invoice is suggested. |

| Due date | Due date is fetched from the project’s terms of payments but can be changed. |

| Accounting date | Today’s date is suggested. If you print out several invoices, the invoice date of the previous invoice is suggested. |

| General inv. text | Field for optional text. If you print out several invoices, it will be printed on all of them. |

Invoice distribution

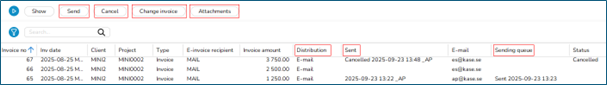

When an invoice is printed without a test print, invoice distribution opens automatically. From there, invoices can be sent electronically, and attachments can be added to emails. Invoice distribution can be found under Accounting | Client invoices, the Invoice distribution tab.

| Show | Invoice in Pdf format |

| Send | Select one or several invoices and click Send |

| Cancel | If an invoice not shall be sent |

| Change invoice | You can change email address here, among other things |

| Attachments | You can fetch attachments that shall be sent together with the invoice |

| Sent | For email, this means that the invoice has been moved to Sending queue. For e-invoices, this means that the invoice has been sent and received confirmation from the receiving server. |

| Sending queue | Status from the sending queue |

Sending queue

When an invoice with email distribution has been sent from invoice distribution, it ends up in System | Sending queue. The sending queue shows the status of the invoice and all previous transmissions, including payment reminders. Here you can see if something has gone wrong during the transmission. If, for example, the email address is incorrect, the invoice should be cancelled in the sending queue and corrected in the invoice distribution system, then sent again.

Create invoice without invoice text ready

- Go to Projects | Invoicing. Find the project either from the Projects tab and press New invoice or from the Invoices tab, press New and search for the project there.

- Follow the instructions Select invoice content and Adjust WIP in this manual (page 2 and 3)

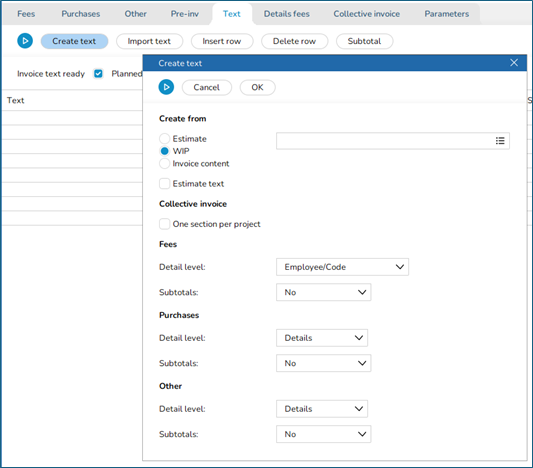

- Create an invoice text. Write an own text or use text suggestions. The suggestions are editable. You can add own rows, make subtotals and write new text and amounts.

- Use the Create text button to fetch the WIP on the project or to invoice from estimated or invoice content.

Invoice text suggestions

| Create text | With the Create text button, a ready-made text and amount from the project budget can be used. You can also fetch amounts from the invoice content or amounts that are actuals in WIP. |

| Detail level | You can select detail level of fees, purchases and other. |

| Subtotals | Determine whether the amounts shall be subtotalled. |

| Import text | If there is a previous invoice that is similar, you can import text from it and edit it to the current one. |

| Instruction | The project manager can write instructions to Backoffice regarding the invoice. The instructions are shown in the analysis view, but not in the invoice to the client. |

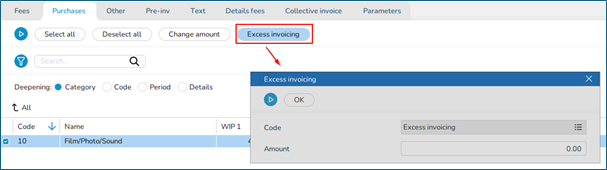

Excess invoicing

Excess invoicing is only available if it has been set in the parameters. It is used for invoicing purchases, where the purchase invoice for it hasn’t come yet.

- Enter excess invoicing code, if it’s not shown as default, and amount to invoice.

- It is possible to both excess invoice and invoice from existing WIP on the same invoice.

- The excess invoiced amount is shown as a minus WIP on the project, until it is settled.

- The settlement is made by creating an invoice with content, where the excess invoiced amount is cleared against a real WIP .

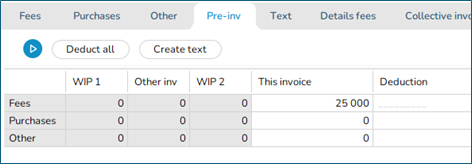

Pre-invoice

- Go to the Pre-invoice tab.

- Enter the amount to be invoiced in the This inv. field. If the parameter is set to separate fees, purchases and other, they will be divided. The division can be shown in reports.

- It is possible to pre-invoice and use amount from WIP in one invoice

Pre-invoice deduction

- Go to the Pre-invoice tab.

- Enter the amount to be deducted in the Deduction field. Use the Deduct all button if you want to deduct the whole amount.

- Under the tabs Fee, Purchases and Other, you can specify what the pre-invoice should be deducted against using the same procedure as when creating a regular invoice.

Collective invoice

Collective invoicing means that several projects are invoiced in one invoice. The requirements are:

- Same client code

- Same client number

- Same invoicing currency

- Parameter Allow collective invoicing is activated

There are two ways to create collective invoices. Either the invoice is created from scratch, or separate invoices are created for each project and then merged.

Create collective invoice from scratch

- Begin with adjusting possible WIP amounts in the projects. The projects must be adjusted before they are merged to a collective invoice.

- Go to one of the invoices, to the Collective invoice tab and tick the Collective invoice field.

- Fetch all other projects that shall be included in the merge, also the one you are creating the invoice in.

- The Fees, Purchases and Other tabs now show the WIP of all included projects. You can enter the amount that shall be invoiced.

- Select deepening: Project to see the invoice content of each project.

Create collective invoice by merging invoices

- Prepare the invoices with text and content on each project

- If you use excess invoicing or if invoice text exists, use the Merge button.

- When all invoices are prepared, select them and use the Merge button.

- Select the project to which the invoices should be merged.

- In the Text tab, a section has now been created for each project, with the project code and name as the heading for each section.

Invoices in foreign currency

- Make sure that the currency rate is up to date in the currency register.

- The invoice currency setting is in Projects | Backoffice | Base registers |Clients and projects, in the Invoicing tab on the project.

- Only the invoice text can have foreign currency. The invoice content is always in your company’s base currency. Marathon recalculates the amounts according to today’s rate.

- The invoice shows the amounts in different currencies depending on the tab. The text tab shows the amounts in the summary table in the upper right corner in the invoice currency.

In the tabs Fees, Purchase and Other or Pre-invoice, all amounts, including the text, are converted to the base currency. Since the currency rate can vary from one day to another, a minor discrepancy is allowed. Enter allowed discrepancy percentage in Projects | Backoffice | Base registers | Parameters, Invoicing tab, field “Max. currency discr on foreign invoice text”. The invoice list shows amount in base currency and invoicing currency.

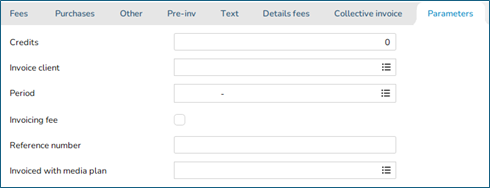

Parameters on the invoice

| Credits | Reference for credit invoices. Enter number of the invoice that this one credits. |

| Invoice client | If the invoice is to have a different billing address than the one listed on the project, you can enter an invoicing client here.

Register an invoice client in Projects | Backoffice | Base registers, Invoice clients. It will be assigned a client number in the sales ledger. You can enter the invoice client number both here and on the project. |

| Period | Backoffice | Base registers | Parameters, Invoicing tab. |

| Invoicing fee | Backoffice | Base registers| Other-codes. The code must also be specified in the project. |

| Reference number | The reference number is always fetched from the project, but you can change it here for a single invoice. |

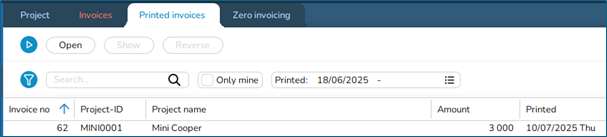

Reprint invoice

If you need to reprint an invoice, go to Printed Invoices tab and print out again.

Credit or reverse invoice

Invoices are credited in full under the Printed Invoices tab.

- Go to the Printed Invoices tab.

- Find the invoice and press the Reverse button.

- A new invoice is created, similar to the original but as a credit note.

Credit or reverse part of invoice

The easiest way is to reverse the invoice in its entirety and create a new invoice with the correct amount. It is possible to make a negative adjustment to the amount to be credited.

- Make a new adjustment and enter employee code, the job code that shall be credited, period for the actual time and negative amount.

- After the adjustment has been made, the project has a negative entry that can be invoiced.

- After the invoice has been printed, the amount can be adjusted back and will then be in the project’s WIP.

Invoice client

If a project is to be invoiced to a different billing address, an invoice client must be used. T will be assigned its own client number in the sales ledger. Register Invoice client in in Projects | Backoffice | Base registers, Invoice clients. You can use Invoice client in two ways.

- All the project’s invoices

- If the project always shall be invoiced to a different billing address, the invoice client should be connected to the project.

- Connect the invoice client in the project in Projects | Backoffice | Base registers | Clients and projects, in the Contacts tab, field Client no.

- You get access to the Clien no. field when the synchronisation between client and project is off. Turn it off in the Parameters 2 tab.

- Single invoice

- If a specific invoice has a different billing address, enter the Invoice client in the invoice, Parameters tab, field Invoice client.

Delimit WIP

It is possible to delimit the WIP so that nothing from later periods is included. The delimitation is based on the accounting date and not the execution date. Pre-invoiced will not be included. Activate delimitation in Projects | Backoffice | Base registers, Parameters, the Invoicing tab.

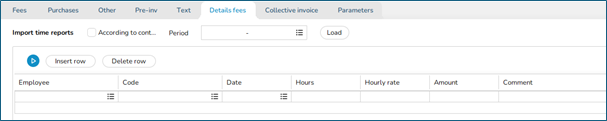

Details Fees

In the Details Fees tab an invoice specification is made regarding fees, with comments from the time report. This will automatically be sent with the invoice in the same Pdf. The function requires a setting in Projects | Backoffice | Base registers, Parameters, Invoicing tab. Also, you need a special print template. Then you see the Details Fee tab in the invoice.

You can use Details fees in two ways.

- Fetch time reports According to content

According to content means letting the system try to fetch the transactions selected under the Fees tab. If there has been adjustments or time corrections, the invoice specification might not be accurate. In that case an error message is shown. All fields are editable and there is no requirements that the specification should have the same amounts as the invoice content.

- Fetch time reports Period

This method fetches all transactions during a selected period regardless of whether entries have been invoiced or not. Approval of project invoices The setting for this function is in Projects | Backoffice | Base registers, Parameters under the Invoicing tab. Tick the Approval box. Authorisations for approval is set in the authorisation matrix under Project accounting | Client and project | Invoices to approve. Not all invoices need approval; invoices marked with “Not to be sent “, credit notes and zero invoices are not shown in the list. Project managers approve in Projects | Projects, Approval tab. They can only see external invoices that belong to their group in the tab. The accounting department can approve in Projects | Invoicing, in the Invoicing tab.

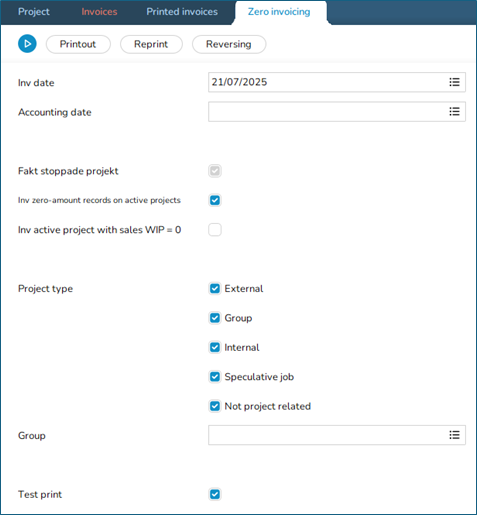

Zero invoicing

Zero invoicing should be done once in a month. It is on Projects | Invoicing, Zero invoicing tab. The reason is that adjusted entries with only a purchase price WIP left are invoiced. This affects the WIP list and invoicing statistics for purchase price. If you use a balance sheet account for purchases, the zero invoicing posts the cost for purchases with purchase price WIP 0. Zero invoices are not sent to clients, but it is important for statistics and for the accounting that you use correct invoicing- and accounting dates. It is not possible to select certain projects for zero invoicing which makes it difficult to select a date in the past. Example: If there are purchases registered in July, that have been adjusted down and the zero invoicing is done with accounting date in June, the cost of the purchase in July will be booked before the purchase actually existed.

Invoice zero entries on active projects This concerns entries with 0 in sales price WIP. Example: A purchase is registered with a purchase price of 10 000 and has a sales price of 12 000. The WIP 12 000 is adjusted down, and the purchase price is still 10 000. When zero invoicing, this purchase price entry will have status invoiced and is no longer in the WIP list. If balance sheet for purchases is used, the invoicing makes the cost posting.

Invoice active projects with sales price WIP = 0 The project will be zero invoiced if the total sales price WIP is 0. Example: There is 10 000 in WIP, fees. There is - 10 000 in WIP, purchases. If you select “Invoice active projects with sales price WIP = 0”, the invoice will be zero invoiced. The fee will be posted as revenue and the purchase as cost, provided that a balance sheet account for purchases is used. The same applies if there is positive WIP on a purchase code and a negative WIP on another, but the total purchase WIP is 0. Select project type on all the projects that shall be zero invoiced. All should be selected. You can choose group, if only one group shall be zero invoiced. Normally the company uses shared project accounting The invoice number for zero invoices will either be one in the ordinary invoice number series or a deviating number series, depending on settings in the parameters.