Media credit

Contents

Credit management

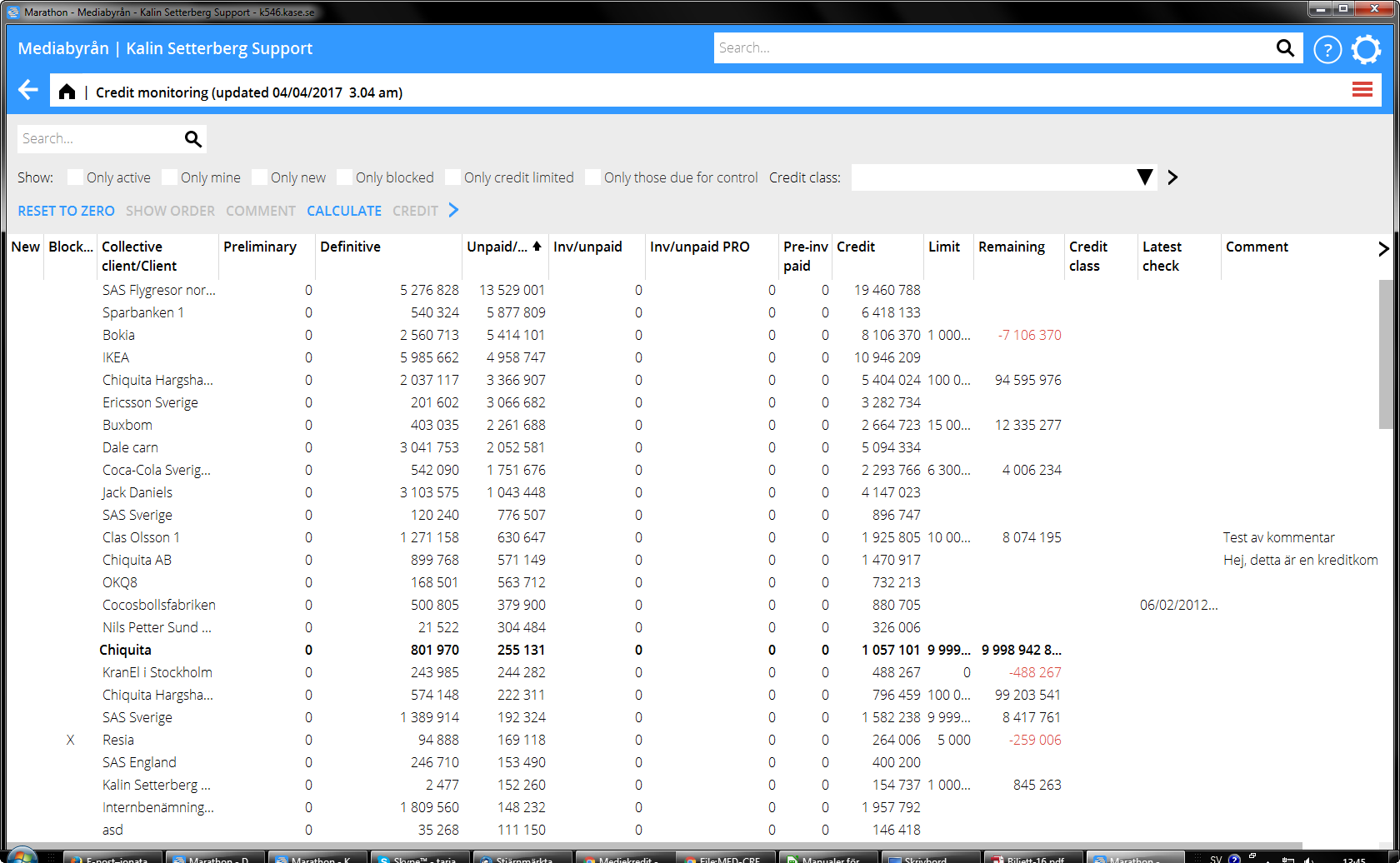

In Media: Credit monitoring you can see how much credit the clients have been using and if they have been blocked.

| Reset to zero | Resetting means that the number of new blocked clients is set to zero. The following night, the system will check blocked clients and when you thereafter check the option "Only new" you will see if new blocked clients have appeared. |

|---|---|

| Show order | Brings you to Media queries and hence to see the content of the invoice. Marathon detects possible allocations; only the main client’s orders are shown. |

| Comment | Field for optional comment. This comment is only shown here. |

| Calculate | Checks current credit on client/collective client immediately if the parameter "Continuous credit check – all functions"” is active. |

| Credit | Select a row and press Credit to see a summary of what the credit includes and a credit graph. |

You can delimit the list by selecting:

| Only active | Shows only active clients |

|---|---|

| Only own | Shows clients where you are client manager. |

| Only new | Shows blocked clients since the last resetting (Reset to zero) . |

| Only blocked | Shows only clients that have been exceeding their credit limit. |

| Only credit limited | Shows clients with a credit limit. |

| Only those due for control | Shows only clients that are due for credit control, provided that a date for control has been set |

Credit limit

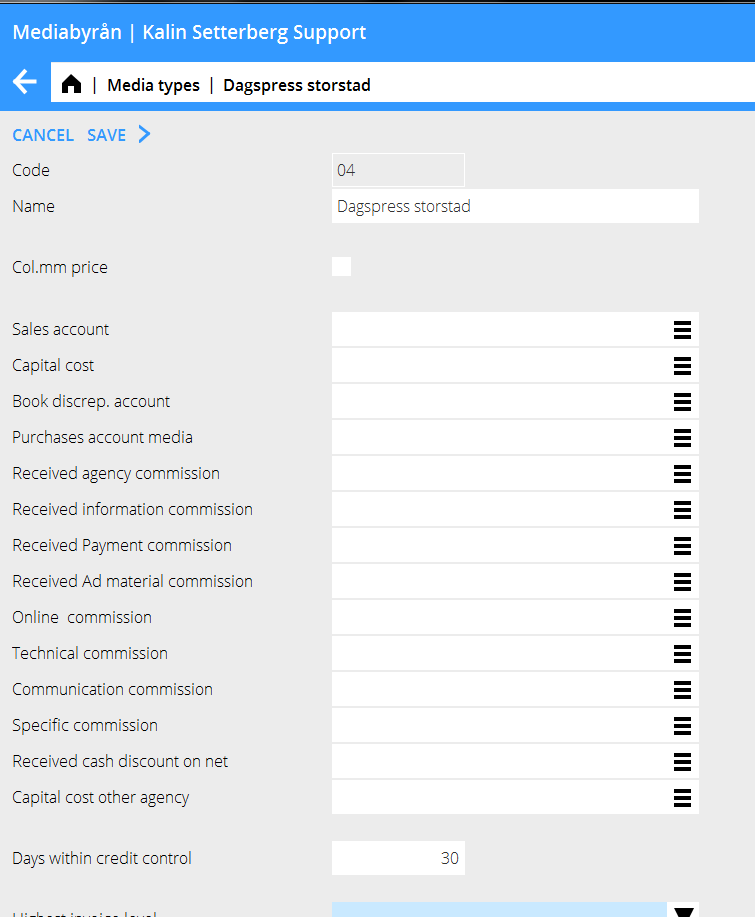

There are two ways of setting a credit limit: On the client or on the collective client (and the collective clients above that). If you set it on a client, Marathon primarily checks it. If it has been set on collective client, all clients connected to it that lack own limit will be calculated in the credit count. The credit is calculated of net amounts and at the time of the check, the net amount is compared to what there has been booked on each media type in the selected intervals. Intervals can be set on the different media types in System: Base registers/MED/Media types.

In the example above we have stated 30 days on this media type. That allows us to do a client plan with a longer time span without it being locked by the credit check. If there is a zero in the field, everything will be included in the calculation.

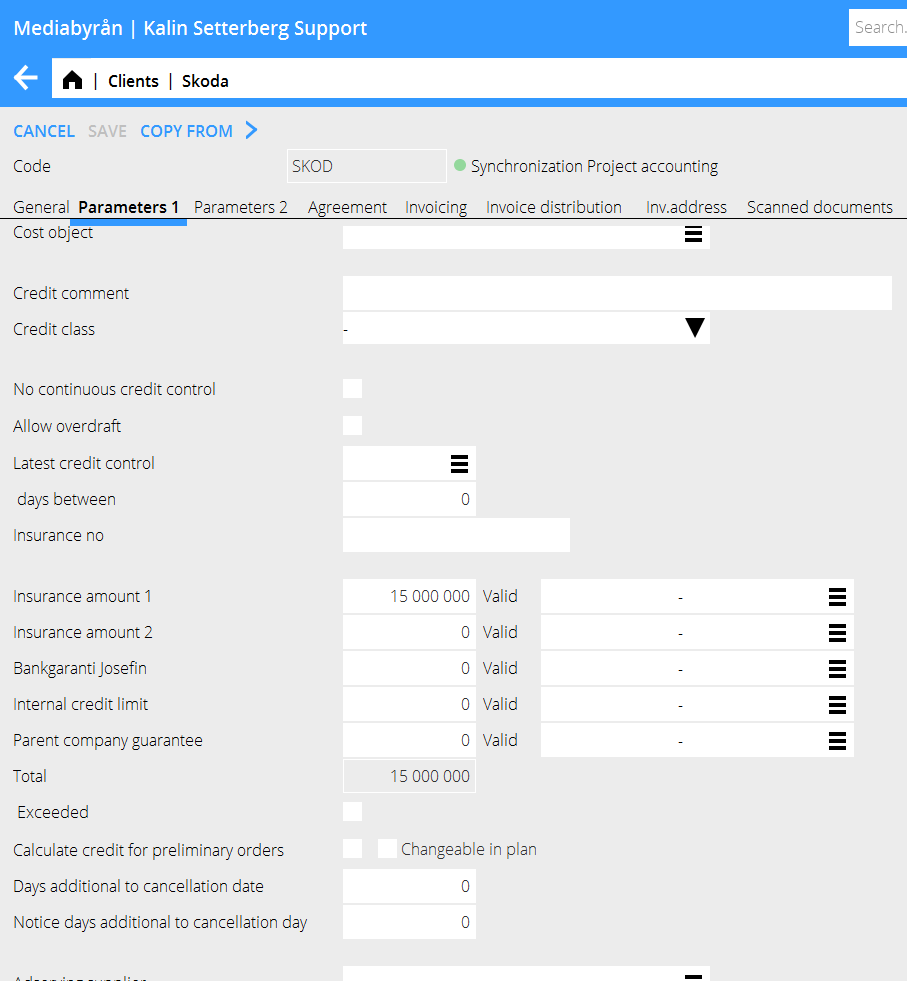

Settings on client and collective client

Settings are done in System: base registers/MED/Clients and System: Base registers/MED/Collective client.

| Credit class | Shown, selectable and possible to sort on in Media: Credit monitoring. |

|---|---|

| No continuous credit check | An chance to deviate from the general setting (continuous credit check) |

| Allow overdraft | The client/Coll. Client is included in the check, but will not be blocked in case of overdraft. |

| Insurance amount1 | You can enter up to five different insurance amounts and mark them with time limitations. |

| Exceeded | If you don’t use continuous credit check you will have to remove the exceeded-mark; otherwise you will have to waituntil the next check to do any bookings. |

| Calculate credit for preliminary orders | Select this if you want also preliminary orders to be included in the credit count. This can be set to be decided on a plan. |

| Days additional to cancellation date | You can add additional days to the date limit set on the media types. |

| Notice days additional to cancellation day | Marathon warns when creating orders. If you for example have set 30 days on a media type, you can start checking 5 days before insertion date and receive a notification 10 days before. |

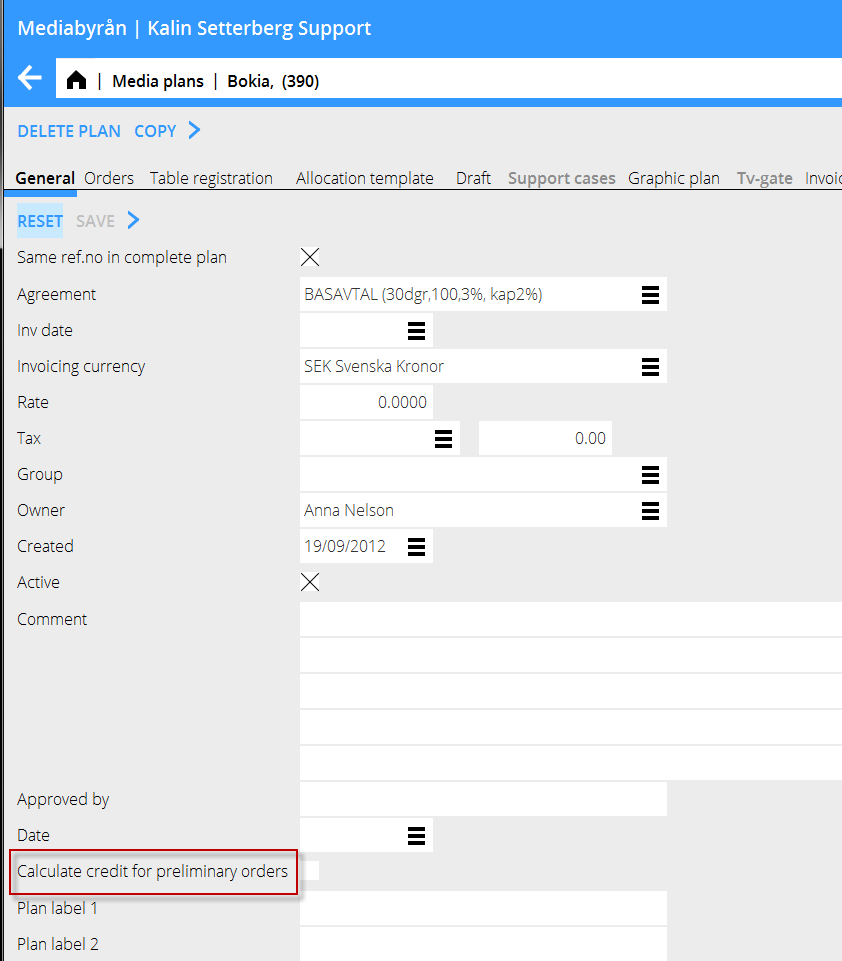

Settings on plan

| Calculate credit for preliminary orders | You can directly, in the general information tab of the plan, decide if preliminary orders should be calculated in the credit count, irrespective what you have set in the client/coll.client information. |

|---|

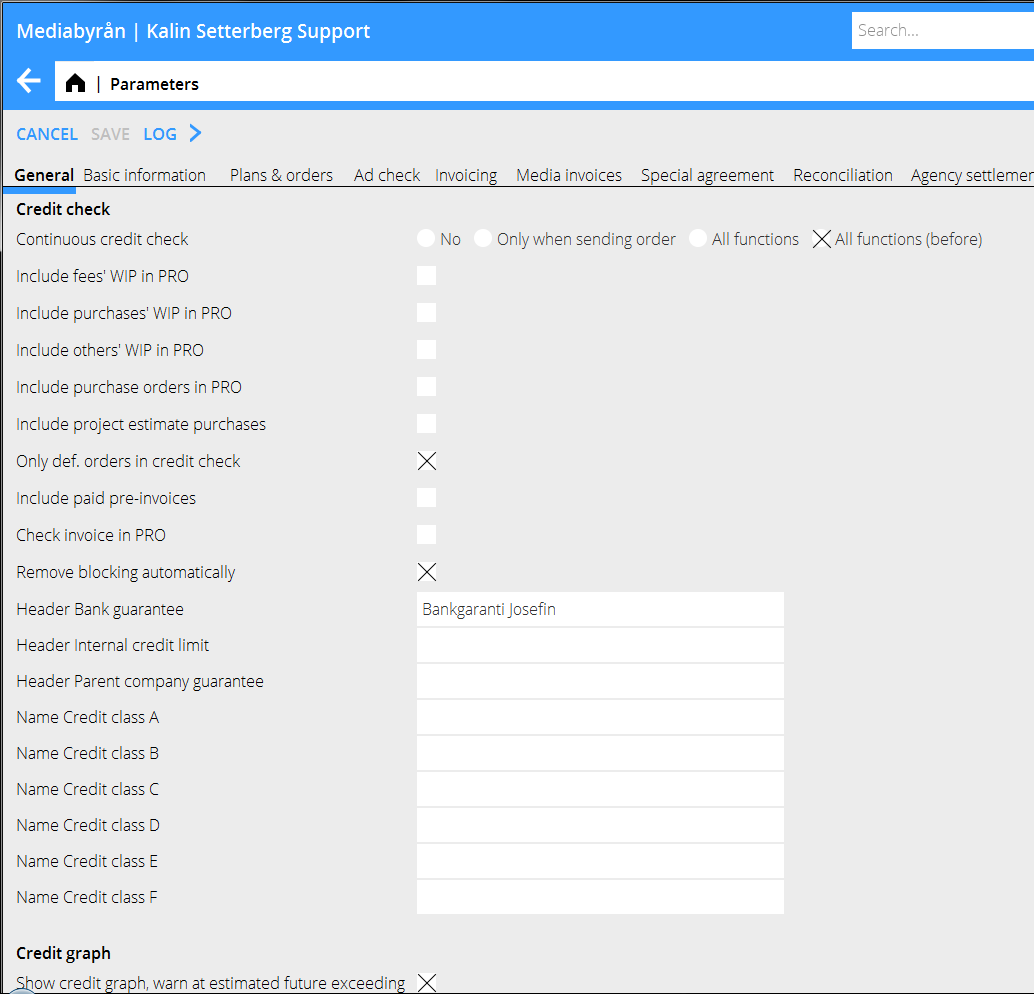

General parameter settings

| No | Normal nightly credit control. The clients/coll. clients are checked and, if the limit has been exceeded, they will be blocked. |

|---|---|

| Only when sending order | Control of booked orders at the time of sending (printing out). |

| All functions | Full credit control immediately when an order is created or booked. This can be avoided on certain clients by including also preliminary orders. |

| All functions (before) | Certain functions such as creating new order or making an order definitive will immediately be checked and leads to blocking if exceeded. Other functions, such as allocation of media combinations and recalculations of yearly agreements will also be immediately checked but possible exceeding will not lead to blocking until the next day. |

Other parameters

(System: Base registers)

| Include fees' WIP in PRO | Fees that are pending on the client’s WIP (Work in Progress) shall be counted in the credit limit calculation. |

|---|---|

| Include purchases' WIP in PRO | Purchases entered on the client’s WIP shall be counted in the credit limit calculation. |

| Include others' WIP in PRO | Other entered on the client’s WIP shall be counted in the credit limit calculation. |

| Include purchase orders in PRO | Purchase orders shall be counted in the credit limit calculation. |

| Ota mukaan ostojen projektikustannusarvio | Luoton arviointiin lasketaan se, mitä asiakkaan projektikustannusarvoissa on budjetoitu ostoihin. |

| Only def. orders in credit check | This function can be managed in client-/coll.client registers if you want also preliminary orders in the credit check. If this parameter is checked, the option will not be possible anymore in client-/coll.client registers. |

| Include paid pre-invoices | If paid pre-invoices shall be counted in the credit limit calculation. |

| Remove blocking automatically | Removes blocking automatically from client-/coll.client in the nightly check when the exceeding has been handled e.g. as a payment entry from the client. |

Credit graph

The credit graph needs additional time, at least oen day, in order to estimate payment- and invoicing dates. The additional time for invoicing is set per media type.