News:Disbursement of expenses via the Purchase Ledger

| Published | 2014-01-08 |

|---|---|

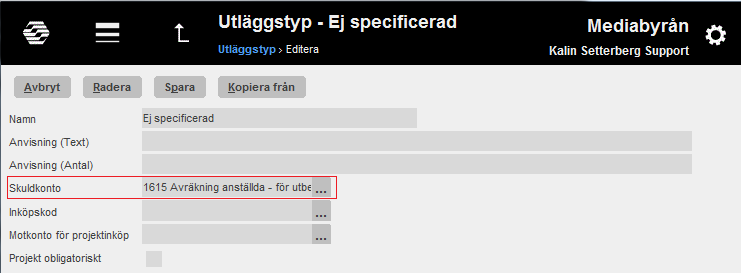

| Module | General ledger |

| Version | unknown |

| Revision | 27005 |

| Case number | 720826 |

| News link | 3777 |

It is now possible to pay out expenses to employees via the Purchase Ledger. Basically, all types of payments are working. Bank account without notification is though the payment method that suits payouts to employees best. The following settings are required for setting up “Bank account without notifications”".

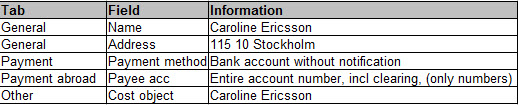

1. The employee is filed as supplier in the suppliers’ record, fill out the fields below.

2. Open a new account that is assigned to the purchase ledger, with mandatory cost object, for example account 1615.

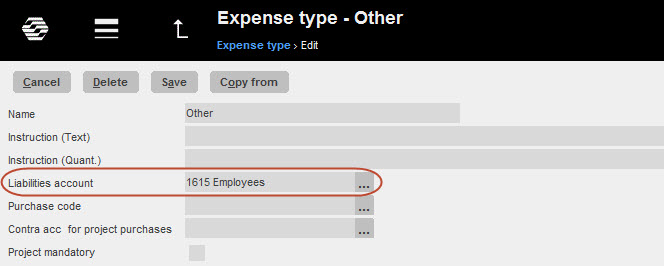

3. Select a liability account for each type of expense, into which expenses with certain types can be redirected for payout via account transaction. By managing the payout methods with expense types, it will be possible to continue regulating e.g. advances or taxable expenses via an a receivable account.

| Booking and disbursement of expenses |

|---|

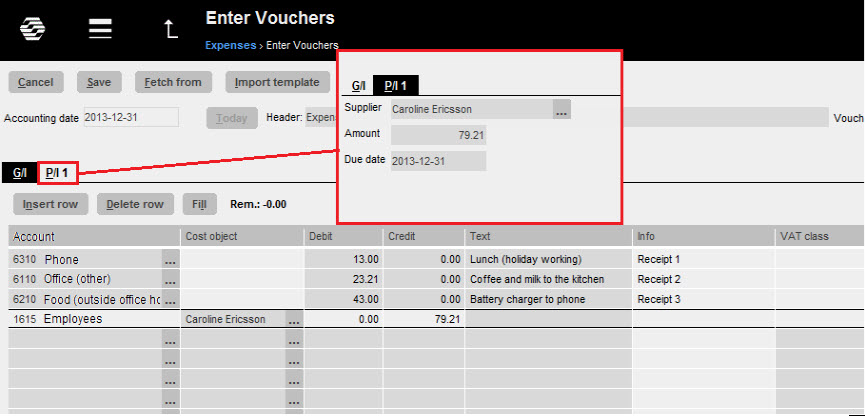

In the procedure for booking expenses, the assignment tab P/L shows supplier, amount and due date.

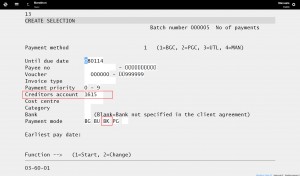

4. Make a payment selection in 03-60-01 based on the liabilities account that the expense type is marked with. Choose payment method BK.

The payout is executed in the same way as payments of suppliers’ invoices; either with the Payments’ program or with file transactions to the bank.