News:New year 2013 detailed

| Published | 2012-12-20 |

|---|---|

| Module | /General |

| Version | unknown |

| Revision | 23005 |

| Case number | unknown |

| News link | 2950 |

Contents

- 1 SYSTEM ADMINISTRATION

- 2 New accounting year

- 3 Automatic login to correct year

- 4 GENERAL LEDGER

- 5 Accounting periods

- 6 Dimensions

- 7 Voucher numbers

- 8 Transfer Opening Balances

- 9 Error list in OB transfer

- 10 Split accounting year

- 11 Reconciliation of periodical allocations

- 12 In case of discrepancy

- 13 Change chart of accounts

- 14 Blocked period

- 15 Error in Vat account parameters

- 16 SALES LEDGER

- 17 Parameters in the Sales Ledger

- 18 Reconciliation Sales Ledger

- 19 In case of discrepancy

- 20 PURCHASE LEDGER

- 21 Parameters in Purchase Ledger

- 22 New accounting year in Marathon approval routine

- 23 Reconciliation Purchase Ledger

- 24 In case of discrepancy

- 25 PROJECT ACCOUNTING

- 26 Working hours’ description and calendar

SYSTEM ADMINISTRATION

New accounting year

Activate the new accounting year in Base registers/General/Companies.

Select company and press OPEN. Click on the tab G/L. Here you can see all accounting years activated so far (start – end). Click NEW YEAR below the accounting year box. Save before you make any possible changes. If you have several companies, repeat this for each of them.

Parameter files will now be created in the General Ledger, Sales Ledger and Purchase Ledger for the new accounting year.

After that you can log in to the new accounting year. Press F8 and the letter B in Classic and write in the year number. Press Enter.

Automatic login to correct year

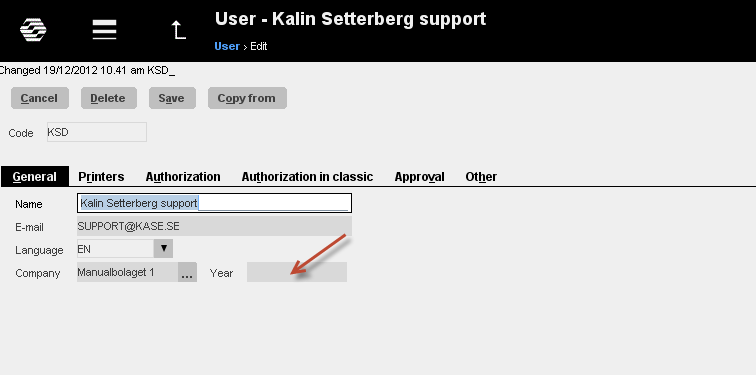

Go to the User files in Base registers/General/Users. Write in year in the field Company/Year. The user will automatically log in to this accounting year. If you leave the field blank, she/he will automatically log in to the latest activated accounting year.

GENERAL LEDGER

Accounting periods

After activating the new accounting year, ensure that the accounting periods for your company/companies are correct. Go to Base registers/GL/Parameters (01-10-90). Remember to log in to the new accounting year when checking! Note, that all periods except the first shall be closed.

Dimensions

If you use Dimensions, check that they are set in Base registers/GL/Parameters

Voucher numbers

Check also the voucher number series. Go to Base registers/GL/Voucher sequences .

Bookkeeping vouchers (with the prefix BO) can be handled in two different ways. Either you use a number counter for the complete accounting year, or you change number counter every month:

- If you are using only one counter, the first number is set to 1.

- If you use separate counters each month, the first number is set YMM001. Y means year unit, MM means month number and the rest is a current number.

You can, if you want, change numbering method when making the check.

If you use other voucher series than standard (BO), they have also to be updated for the new year. This can only be done in Base registers/GL/Voucher series.

Transfer Opening Balances

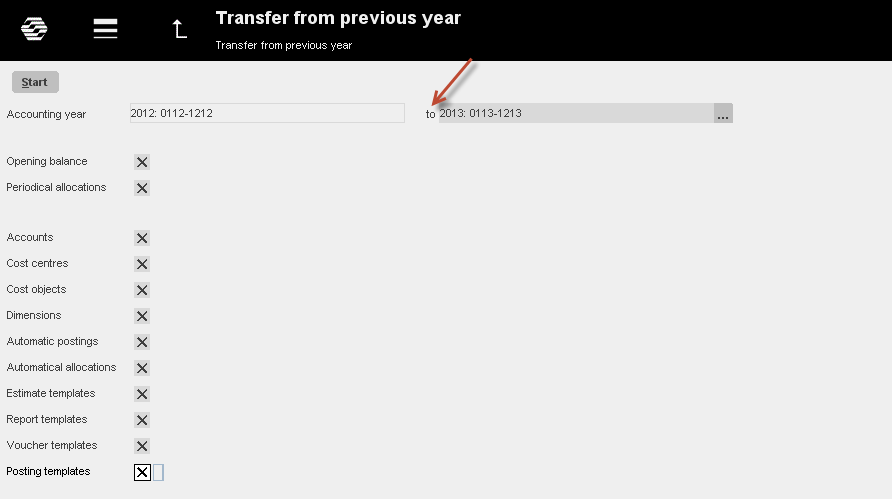

Before you can start to use the General Ledger, you must transfer files from the previous year. Use the program in Bookkeeping/Transfer from previous year.

Select Accounting year To and the accounting year From will also be changed.

Select everything that shall be transferred. Normally you want to transfer all. Marathon confirms with a list. The current amounts will be moved from the old accounting year to the new one.

The previous years balances from your Closing accounts will automatically be relocated as Opening balance on the account for Profits and losses brought forward. The account number for this is set in Base registers/General/Parameters-Other

You can continue to make bookings in the old year after you have activated the new. Note, that changes in the old accounting year not automatically will change opening balances in the new accounting year. Every time you want to update the new accounting year’s balances, you must run the transfer program You can make the OB transfer as many times you want.

Error list in OB transfer

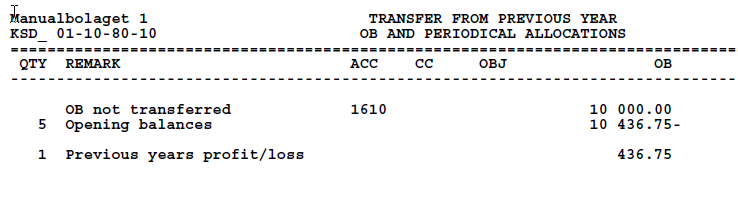

If some problems occur in the transfer, Marathon generates an error list. In most of the cases, the reason is that there have been changes concerning assignments to or from cost centres and -objects on an account. If there e.g. is a transaction in the old accounting year that includes an account where cost centre was mandatory before, but now no longer is allowed, the OB can not be updated:

In the above example, one of the balance updates has failed. Sometimes during year 2012 the conditions for Cost Object have been changed on account 1610. In this case, cost object was previously (during the booking of this record) optional, but has later been changed into mandatory. Therefore, the balances could not be brought forward.

There are two ways to correct this:

- In the new accounting year (13), go to Base registers/Bas/Accounts (01-10-10).Select the account and change “Assign to cost object” to OPTIONAL. Then, run the transfer again.

- In the old accounting year, (12) book away the amount on the account with the old Cc/Obj settings and then book it back with the new settings, in the same voucher. Before booking, set “Assign to cost object” to OPTIONAL. This way the problem will not occur next time you create a new accounting year.

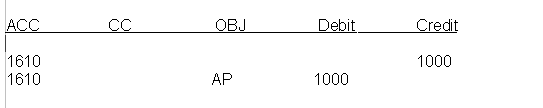

Example: Account no 1610 with erroneous cost centre AP:

After booking, run the transferring program again.

Split accounting year

If you apply to split accounting year, do not activate the new accounting year until the old year is to its end.

Reconciliation of periodical allocations

- Update the allocations for the period in 01-41.

- Print out the list in 01-62 and compare with 01-51.

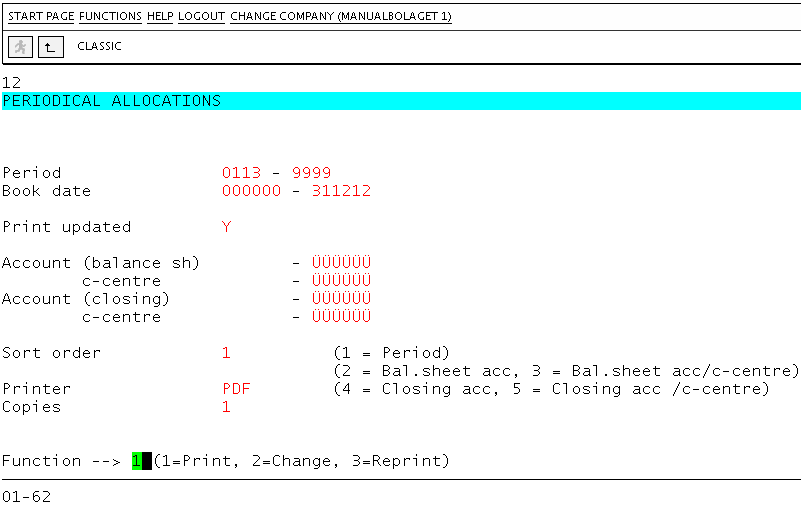

Selections in 01-62

- Select from-period.

- Select to-period.

- Change selections and sorting so that it matches your wish.

In case of discrepancy

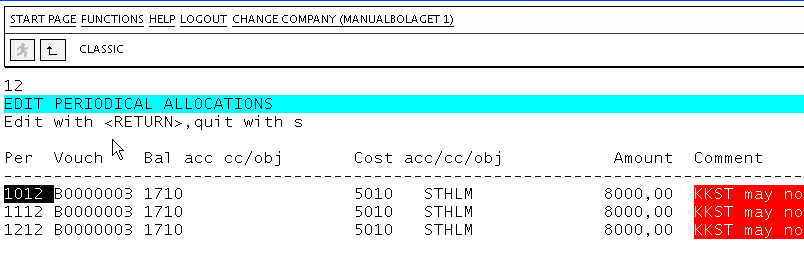

If you find discrepancies, go first to 01-99-03. Here is a list of all periodical allocations that for some reason not have been updated. One common reason is that there have been changes on the account regarding cost centres/objects. Correct the allocation in this same program. Use arrows to go to the selected line, press Enter and make the change (e.g. delete CC).

Another common reason to discrepancies is that there are allocations which are not updated in the previous year. The integration code can also have been removed from the balance sheet account without correction on the allocations.

When you update balances from previous year, there is an option to import periodical allocations. If you select this, you will only get the allocations that belongs to the new accounting year and that haven’t been transferred before.

Change chart of accounts

If you want to change your chart of accounts in Marathon, you will need help from Kalin Setterberg to make the conversion. Before the conversion, fill in 01-10-15 which accounts that should be corresponding to which in the new chart of accounts. You don’t need to fill in the accounts that not will be changed. You can also merge accounts into one account. This must be done in all years that shall be converted. You can copy the table in 01-10-15 with the F7-key. The conversion can be made any time during the accounting year.

Blocked period

If a period is blocked, bookings cannot be made in it. Activate a period in Base registers/GL/Parameters, tab periods. Check that the period is marked with ACTIVE . If you work in Classic, ensure that you are logged in to right year- change year with F8+ the letter B.

Error in Vat account parameters

Go to Base registers/GL/Parameters – Vat .Check that you have correct accounts for input and output tax. Check that the tax accounts are entered in the chart of accounts. If you cannot see the chart, you haven’t been updating it in the transfer program.

SALES LEDGER

Parameters in the Sales Ledger

The parameters for the Sales Ledger are created when you activate a new accounting year. Check in Base registers/SL/Parameters/Parameters1 that the number counter for Next Voucher number for corrections is set to accounting year + 0001, e.g. 130001.

Use Base registers/SL/Parameters/Parameters1 to move accumulators (balances) to current year, so that the balances agree in the inquiries’ program 02-50. If you want the balance to be for year 2013, write in 010113 in the date field (130101 if you use an older version of Marathon).

Error in invoice update

One of the most common reasons to error in updating invoices to S/L, which occurs in connection with change of year, is that you are logged in to wrong accounting year. If so, you will receive an error message that says “belongs to another acc.year”. Change year with F8 and the letter B and renew the update.

There might also have been changes in the account settings, which make update impossible. At the update you will receive an error message that describes the problem. Many times accounts need Cost objects or -centres or an account is missing from the chart of accounts.

If the error is in the chart of accounts, go to Base registers/GL/Accounts Make the changes regarding Cost centres and Cost objects (check in 02-80-12 which accounts need corrections), or create a new account. After the changes, update invoices again.

If the error isn’t in the G/L and chart of accounts, make the corrections on the invoice and in the project accounting. Change the invoice in 02-80-12. Press Enter and 1, Update. In the bottom left corner, repost the invoice. Update the invoice again in 02-80-10.

In the Project accounting, look over all codes and make sure, that they have correct accounts registered. Print to Export in Base registers/PA/Cost codes and make the changes there.

Reconciliation Sales Ledger

Check that all invoices are updated in 02-80-10. Make an age analysis in 02-71 per reconciliation date. If you use several accounts receivables, use Sorting=3 to split the accounts. Check with the account receivable in 01-51.You can also use the balance list in Backoffice/Sales Ledger/Balance list, or 02-70, in the reconciliation.

In case of discrepancy

Print out the list “Reconciliation G/L” in 02-72 to see the date, when the discrepancy occurred. Write in reconciliation period and “Summary only=Y”. Print then out the same list again, but this time with “Summary only=N”.

If the discrepancy has occurred because a payment with voucher number BO 000001, the problem is seemingly that 02-60 has been used for registration of the payment. The payment will in that case only be booked in the Sales Ledger and not in the General Ledger.

Another common reason to discrepancy is that bookings have been made without integration code on the account. I n 01-52 you can see what date the discrepancy occurred. If that has happened, the booking has to be reset and booked again with integration.

If the voucher type is K3, the reason is that something in the invoice has been corrected and updated with function 3, which means that it hasn’t been posted. The correction will not be visible in the book keeping.

PURCHASE LEDGER

Parameters in Purchase Ledger

Marathon automatically creates parameters for P/L when you activate a new accounting year. Check the number counters in Base registers/PL/Parameters (03-10-90-01). They should be set as following:

Next voucher no – invoices (LF) accounting year + 0001, e.g. 130001

Next voucher no – invoices/corrections (LF) accounting year + 001, e.g. 13001

If you use Marathon Approval and have AT-numbers as voucher numbers, you don’t need to check “Next invoice number – invoices”.

Use Base registers/PL/Parametres/Other to move accumulators (balances) to current year, so that the balances agree in the inquiries’ program 03-50. If you want the balance to be for year 2013, write in 010113 in the date field (130101 in older versions).

Update bank holidays for 2013 and 2014 in Base registers/PL/Bank holidays.

New accounting year in Marathon approval routine

When you make postings in Preliminary entering, Approval or Watch list, you will see the chart of accounts that has been updated most recently. This happens also if you are booking on the previous year. Remember to transfer the chart of accounts in Bookkeeping/Transfer from previous year when you activate a new accounting year.

Reconciliation Purchase Ledger

Print out Age analysis in 03-71 per reconciliation date. If you use several accounts payables, use Sorting=3 to split the accounts. Compare with the account payable in 01-51.You can also use the balance list in Backoffice/Purchase Ledger Ledger/Balance list in the reconciliation.

In case of discrepancy

Print out “Reconciliation G/L” in 03-72 to see what date the discrepancy occurred. Enter period and “Only Summary= Y”. Then print out the same list, but this time with “Only Summary=N”.

If the voucher type is L3, the reason is that something in the invoice has been changed in 03-32 and updated with function 3 which means that it hasn’t been posted. The change is therefore not shown in the book keeping.

If bookings have been made without integration code on the account, discrepancies occur. Check in 01-52 what date it occurred. If booking without integration has been done, it has to be reset and booked again with integration.

PROJECT ACCOUNTING

Working hours’ description and calendar

The calendar and the working hour’s description must be updated before Marathon Time can be used in the new accounting year.

You can see what calendar number each person is connected to in the employee files in Base registers/PA/Employees .

Create calendars for different working time measures in Base registers/PRO/Calendar. Click NEW and write in 2013, same calendar number as before and name. Write in amount of expected working hours per day in the field “Time/day”.

In the tab WORKING DAYS, write in which days that are working days and which are not. A working day is expressed as a digit with two decimals. A complete working day is 1,00, half day is 0,50 and a free day is 0,00. Note, that if you click “IMPORT STANDARD” you will automatically get a Swedish standard calendar. You can of course edit the imported calendar to suit you.

You can copy working days from a calendar to another, as long as it is in the same year. Remember to change hours per day and the name after copying.